Cgu Ifrs 16 / Pin On Accounting

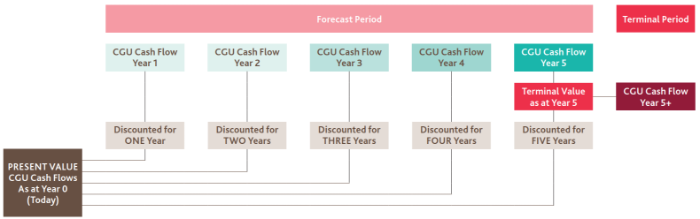

IFRS 16 sets out the principles for the recognition measurement presentation and disclosure of leases for both parties to a contract ie. The cash flow forecast and discounted cash flow models.

Ifrs 16 Impact On Valuations V2 Pdf Pdf Deferred Tax Valuation Finance

Applying IAS 36 Impairment Published 10 December 2019 last updated 10 December 2019 4 section 8 explains that any impairment loss must be allocated to the assets in the CGU in a specific order.

Cgu ifrs 16. I first against any goodwill allocated to the CGU. The treatment of lease liabilities. The new leases standard IFRS 16 Leases applies to annual periods beginning on or after 1 January 2018 so would impact financial statements for years ending 31 December 2019 and 30 June 2020While many entities lessees in particular are still grappling with the mechanics of lease accounting under IFRS 16 a lesser known.

Short-term leases and leases in which the underlying asset is of low value. IFRS 16 cash generating units. Lease accounting 3 Lee BV is een fabrikant met meer dan 1000 man personeel in dienst.

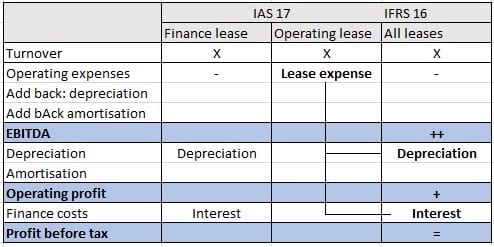

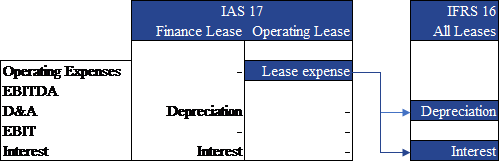

Associates IAS 282011 Joint ventures IFRS 11. To ifrs 16 number crunching accounting for the right-of-use asset and lease liability all in the planning putting together an implementation plan that will succeed ifrs 16 leases. Comparison of Impairment under IAS 17 and IFRS 16 The carrying value of the CGU from ACCOUNTING AUDITING at University of the South Pacific Fiji.

IFRS 16 is effective for annual reporting periods beginning on or after 1 January 2019 with earlier application permitted as long as IFRS 15 is also applied. Therefore general IAS 21 provisions apply. IFRS 16 does not have specific provisions on the impact of foreign currency exchange differences arising on lease liabilities.

Under IFRS 16 a lessee can choose not to apply the right-of-use model to some leases ie. How to amend impairment models for right-of-use assets under IFRS 16. In particular it means that the value of right-of-use asset cannot be adjusted by the foreign currency exchange differences arising on lease liabilities IFRS 16BC196-BC199.

2 welcome 2017 ifrs 16 leases. IFRS 16 continues to address lessee and lessor accounting on a pre-tax basis even if tax considerations are often a major factor when a company is assessing whether to lease or buy an asset and when a lessor is pricing a lease contract. The standard provides a single lessee accounting model requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value.

IFRS 16 specifies how an IFRS reporter will recognise measure present and disclose leases. For these leases the lessee includes the future lease payments in the cash flow forecasts when calculating the CGUs recoverable amount. In januari heeft de IASB de langverwachte nieuwe lease-standaard IFRS 16 uitgebracht.

Lessors continue to classify leases as operating or finance with IFRS 16s approach to. IFRS 16 Leases interaction with other standards At a glance Under IFRS 16 lessees will need to recognise virtually all of their leases on the balance sheet by recording a right of use asset and a lease liability. Impairment of right-of-use assets the discount rate.

And Impairment of right-of-use assets. The customer lessee and the supplier lessor. By Katerina Buresova in RegulatoryCompliance 22012019 As weve seen over the last few months IFRS 16 has brought about a lot of changes to the existing treatment of leases especially for lessees.

Als gevolg van deze nieuwe standaard moeten alle lease- en huurverplichtingen zoals huurcontracten met betrekking tot vastgoed met ingang van 1 januari 2019 op de balans komen in de commerciële IFRS jaarrekening van de lesseehuurder. Where an asset does not generate cash flows IAS 36 requires that the asset is allocated to a cash-generating unit CGU being the smallest group of assets that generate cash inflow that are largely independent of each other. While this gross up in total assets and total liabilities is the most obvious impact of adopting IFRS 16 there are a.

Nieuwe spelregels op de commerciële vastgoedmarkt. While the IASB has retained IAS 17s finance leaseoperating lease distinction for lessors and carried into IFRS 16 the. Identifying the CGUs for a business can be time-consuming and complex.

How does impairment look under IFRS 16 Leases. IFRS 1647 49 Is IFRS 16 a pre-tax accounting model. IFRS 16 may impact both a CGUs carrying amount and the way the recoverable amount of the CGU is measured.

IFRS 16 contains a lease so that entities are not required to incur the costs of detailed reassessments. Elements to consider include. Ii then against the other assets of the CGU on a pro rata basis.

Model IFRS 16 An investors interest in the following entities for which the entity accounts for its interest in accordance with the equity method under IAS 28 2011. Het aankomende jaar moet een gedeelte van het personeel veel reizen om leveranciers te vinden voor de productie van Lee BV. The objective of IFRS 16 is to report information that a faithfully represents lease transactions and b provides a basis for users of financial statements to assess the amount timing and uncertainty of cash flows arising from leases.

IFRS 16 replaces the previous leases Standard IAS 17 Leases and related Interpretations. One of the most notable aspects of IFRS 16 is that the lessee and lessor accounting models are asymmetrical. Costs to obtain or fulfil a contract IFRS 15 after the impairment requirements of IFRS 15101-103 have.

Putting theory into practice financial reporting faculty publication.

Have Lease Assets Become Impaired Kpmg Global

Ifrs 16 On Leases Its Impact On Financial Statements And Business Valuation Premier Brains

Ifrs 16 Interaction Between Ifrs 16 Leases And Ias 36 Impairment Of Assets Ep 5

Ifrs 16 Leases The Impact On Business Valuations Accountancy Age

Https Www2 Deloitte Com Content Dam Deloitte Cn Documents Audit Deloitte Cn Audit Ifrs16 Seminar En 190503 Pdf

.png)

How To Amend Impairment Models For Right Of Use Assets Under Ifrs 16 Bdo Australia

Https Www Pwc Com Gx En Audit Services Ifrs Publications Ifrs 16 Impact Of Ifrs On Other Standards Pdf

Https Www2 Deloitte Com Content Dam Deloitte Cn Documents Audit Deloitte Cn Audit Ifrs16 Seminar En 190503 Pdf

Exam Question Impairment Cgu Youtube

Covid 19 Ifrs 16 And Lease Accounting The Impairment Question Intheblack

Impairment Testing Cash Generating Unit With Ifrs 16 Leases Annual Reporting

Have Lease Assets Become Impaired Kpmg Global

Https Www2 Deloitte Com Content Dam Deloitte Cn Documents Audit Deloitte Cn Audit Ifrs16 Seminar En 190503 Pdf

How To Amend Impairment Models For Right Of Use Assets Under Ifrs 16 Bdo Australia

Goodwill Impairments May Not Identify Impaired Goodwill The Footnotes Analyst