Cgu Impairment Testing, Goodwill Impairments May Not Identify Impaired Goodwill The Footnotes Analyst

Order of Impairment Testing held and used Impairment testing starts at the lowest level. Any such changes are accounted for prospectively as a change in accounting estimate.

Goodwill Impairments May Not Identify Impaired Goodwill The Footnotes Analyst

Whether the economic benefits that the asset embodies have dropped drastically.

Cgu impairment testing. 221 Order of testing for corporate assets that cannot be allocated 43 222 Order of testing for assets and cash generating units to which goodwill has been allocated 44 3 Step 6. IAS 1661 Insights 31035030 Disclosure. Generally a right-of-use asset is tested for impairment as part of the larger CGU to which it relates.

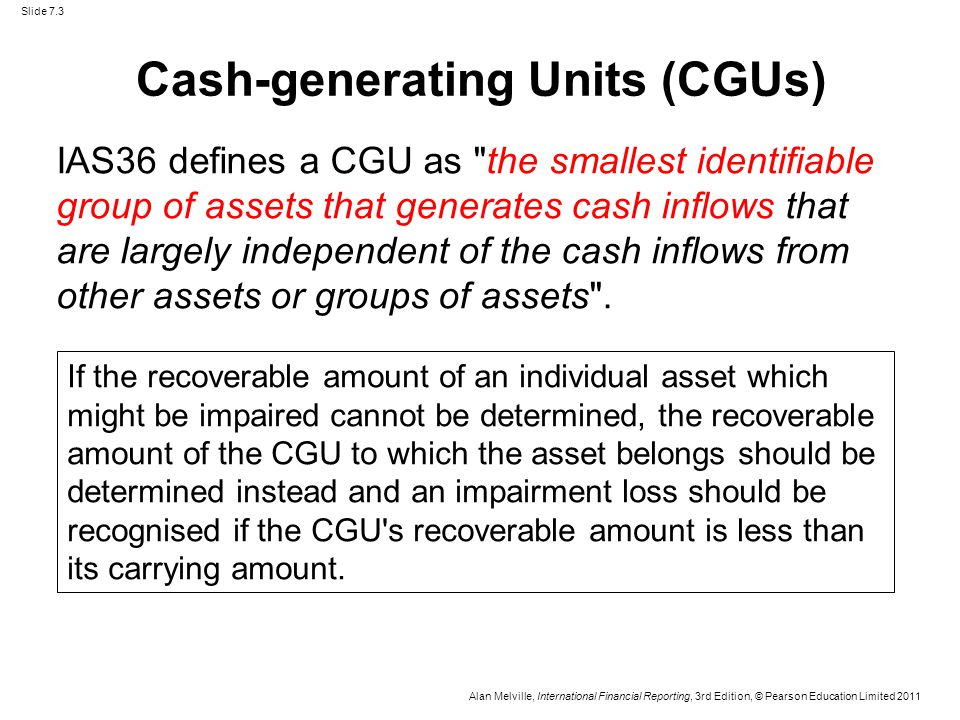

GAAP and a cash-generating unit CGU under IFRS. The CGU had a carrying amount of 1M but the total cashflows expected have a negative value 0f 500K which means the assets carrying value is impaired to Zero. Section 9 outlines additional requirements to consider when testing goodwill for impairment.

Entity A recognised 21m of deferred tax liability relating to brand X 70m x 30 as the tax base of brand X is 0. Although impairment testing of right-of-use assets is generally similar to impairment testing of other non-financial assets additional considerations apply. With the exception of goodwill and certain intangible assets for which an annual impairment test is required entities are required to conduct impairment tests where there is an indication of impairment of an asset and.

GAAP more similar to that under IFRS. However IAS 36 does not use the two-step impairment test found in ASC 360. If not they are tested at CGU level.

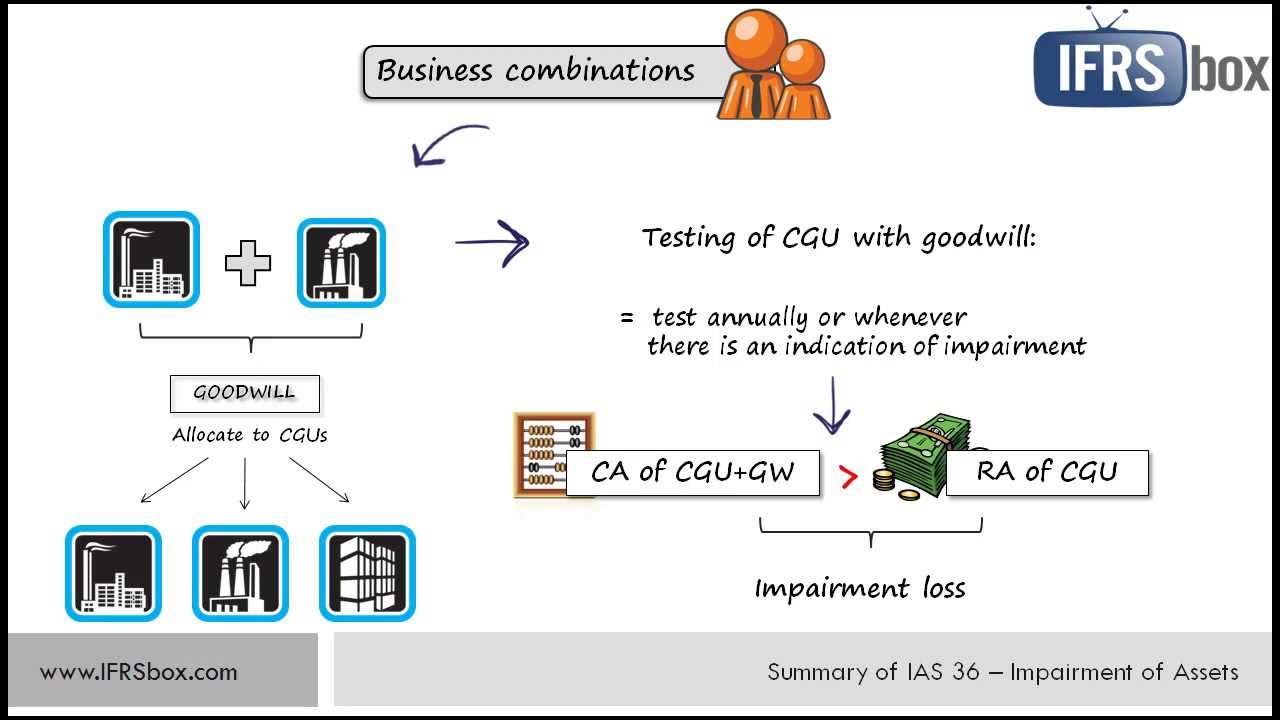

Impairment test is an accounting procedure carried out to find out if an asset is impaired ie. CGUs to which goodwill has been allocated or the smallest. Although the unit of account for the impairment testing will continue to be a reporting unit under US.

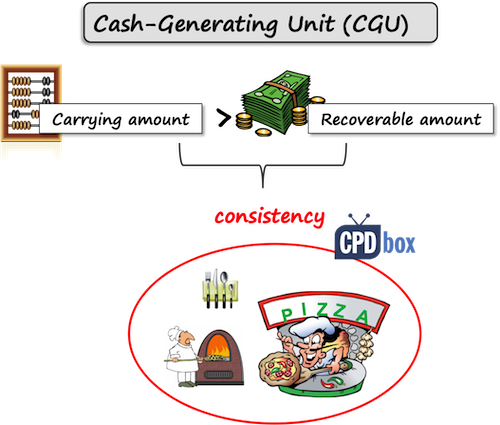

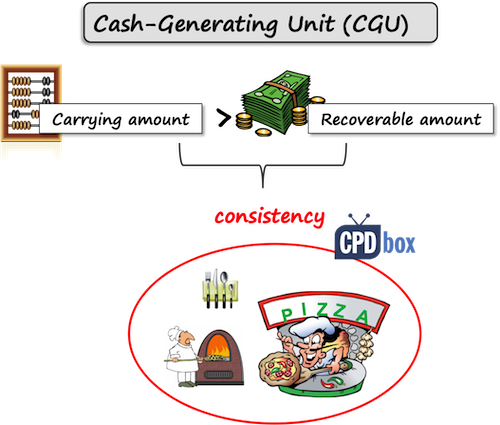

Entity X is a separate CGU and the following assets should be tested for impairment according to IAS 36. In fact cash flow projections are crucial in the impairment testing for two reasons. If impairment indicators are present the carrying value of the asset is compared to its recoverable amount.

Leased corporate head office which must be allocated appropriately to CGUs for impairment testing purposes. Please read our article How to amend impairment models for right-of-use assets under IFRS 16 below for more information about how VIU calculations will change when CGUs include ROU assets. If goodwill relates to a CGU but has not been allocated to the CGU then the CGU is tested excluding goodwill.

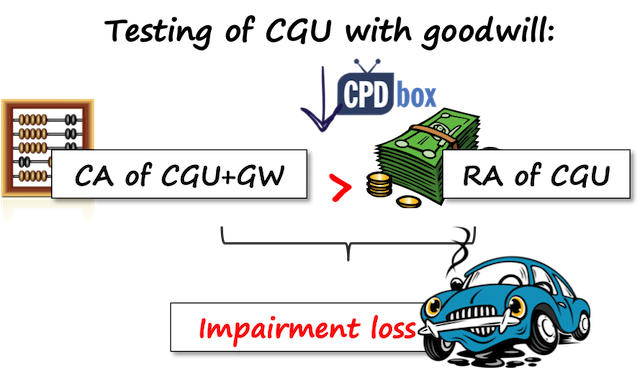

Impairment testing of goodwill allocated to the d2h cash generating unit CGU was performed at the balance sheet date and an impairment loss. Fair value less costs to sell The amount obtainable from the sale of an asset or CGU in an. Under US GAAP if the carrying value of an asset exceeds the sum of undiscounted expected cash flows of an asset the asset is impaired.

Fair value less costs to sell. Goodwill and corporate assets are examples of assets that cannot be tested for impairment individually and must be assessed as part of a CGU or group of CGUs. Impairment testing of cash-generating units with goodwill and NCI Ind AS 36 Impairment of Assets requires an entity to test goodwill acquired in a business combination each year for impairment.

The impairment test compares the assets or CGUs carrying amount with its recoverable amount. Presentation of contract costs. The testing for impairment involves comparing the recoverable amount of a Cash Generating Unit CGU with the carrying amount of the CGU.

Once adopted the simplifications will make goodwill impairment testing under US. They are the basis for determining the assets or cash generating units CGU value in use. Impairment testing under IAS36 Definition of recoverable amount Paragraph 18 IAS 36 The higher of an assets or a CGUs.

After performing an impairment test at a contract level contract cost recognised as an asset are included in the carrying value of CGU to be tested for impairment under IAS 36 IFRS 15103. I have an interesting case in impairment of CGU. The accuracy of an impairment test will be affected by the extent and subjectivity of estimates and judgements in.

The brand will not be amortised so deferred tax will be released following a disposal of or impairment loss on the brand. Disclosures related to impairment testing are likely to be a focus area for regulators. IFRS 16 may also result in the recognition of more corporate ROU assets eg.

IFRS 15 is silent on presentation classification of incremental costs of obtaining a contract and costs to fulfil a. Its value in use. If possible assets are tested individually.

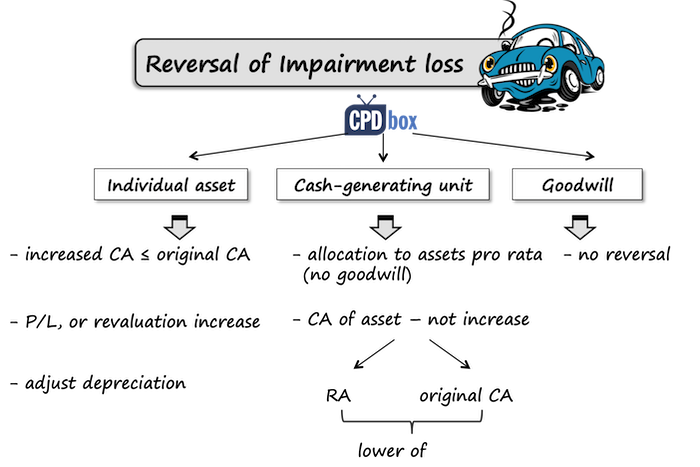

This review may also be required after testing a CGU or an asset for impairment. The recoverable amount is the higher of the amounts calculated under the fair value less cost of disposal and value in use approaches. Details of the valuation technique and key assumptions used to measure fair value less costs of disposal where the fair value is categorised as Level 2 or 3 in the fair value hierarchy and the asset or CGU has been subject to an impairment loss or reversal of impairment loss in the year IAS 36130fii iii.

When you are setting the value in use you are estimating how much value the business gets out of the asset when using it or consuming it. Similarly IAS 36 Impairment of Assets IAS 36 identifies how to calculate and record impairments of long-lived assets. When using present value techniques to the recoverable estimate amount of an asset or a CGU the assumptions and cash flow projections used must be updated to reflect the potential effects due to COVID-19.

Based on projections as of 31-12-2017 which show huge net outflows in the first year then positive net inflows afterwards. The higher of fair value less costs of disposal and value in use. Recognise or reverse any impairment loss 45 31 Recognising an impairment loss for an individual asset 46.

IAS 36 seeks to ensure that an entitys assets are not carried at more than their recoverable amount ie. Impairment loss reduces. Ii then against the other assets of the CGU on a pro rata basis.

Impairments Impairment Cgu Acca Financial Reporting Fr Youtube

Https Www Efrag Org Assets Download Asseturl 2fsites 2fwebpublishing 2fmeeting 20documents 2f1801080908338930 2f08 02 20 20issues 20paper 20on 20updated 20headroom 20approach 20 20goodwill 20and 20impairment 20 20efrag 20teg 20 2018 03 07 Pdf

Ias 36 Updated Video Link In The Description Youtube

Https Www Bdo Global Getmedia 5f0d9621 8c56 493a B4bc 72c03ba2c122 Ifrb 2020 07 Impairment Implications Of Covid 19 Ias 36 Aspx

How To Test Goodwill For Impairment Cpdbox Making Ifrs Easy

How To Test Goodwill For Impairment Cpdbox Making Ifrs Easy

What About Impairment Of Goodwill Annual Reporting

Chapter 7 Impairment Of Assets Ias36 Ppt Video Online Download

What About Impairment Of Goodwill Annual Reporting

Common Errors In Accounting For Impairment Part 4 Not Testing Impairment At The Correct Unit Of A

Ias 36 Determine If And When To Test For Impairment Annual Reporting

Ias 36 Impairment Of Assets Cpdbox Making Ifrs Easy

Https Www Efrag Org Assets Download Asseturl 2fsites 2fwebpublishing 2fmeeting 20documents 2f1701041547115689 2f13 03 20short 20discussion 20series 20paper 20on 20impairment 20test 20teg 2017 05 10 Pdf

Example 1 Impairment Test T 0 T 1 T 2 T 3 T 4 T 5 Step 1 Download Table

Exam Question Impairment Cgu Youtube

Research Assignment Ra 9 Impairment Testing Company Accounting

Ias 36 Impairment Of Assets Cpdbox Making Ifrs Easy

Https Www Ifrs Org Media Feature Meetings 2017 October Iasb Goodwill And Impairment Ap18b Impairment Revised Pdf